Articles

Because the domestic a home usually comes to renting someone the number 1 house, there’s a difficult ability doing work in residential using this isn’t while the common available market. While the commercial and residential funding groups display some typically common functions, there are many crucial variations among them, as well. Especially, a trader can get significant differences when considering the degree from risk, get back, money, and you can investment needed in domestic against. commercial a house.

Benefits and drawbacks out of investing a home

Not enabling people turf expand less than their foot, she’s already understanding for the first actuary examination under control to sit down for it it upcoming spring season. Their practice is targeted on healthcare employment legislation, medical routine entities, business laws, and you may a house law. This includes termination conditions, extra and you may added bonus agreements, insurance coverage choices, and senior years believed possibilities. Residency programs can get shell out a smaller-than-best income, nonetheless they provide additional advantages too. Ladies medical people earn typically $63,100 per year, when you’re male people secure $63,700, which is up to 1%.

Drawbacks of committing to home-based REITs

- As the legal counsel, the girl habit forcuses to the health law, business laws, and bargain remark.

- Especially, a trader should expect significant differences between the degree away from exposure, get back, earnings, and money needed in home-based against. commercial home.

- Effortlessly and you will easily spending rent online is becoming the norm, for even increasing property management companies.

- Rate things in the a house, and you will protecting money easily makes a change.

- There’s and potential for a lot of time-term enjoy, identical to having one owning a home.

A house have a decreased otherwise bad relationship together with other major resource classes. From the fundamental variation, the new book is within the buyer’s term, and all the newest equipment pond the main rent to guard facing unexpected vacancies. This means you will found sufficient to pay the financial also if the equipment are empty. Similar to regular bonus-investing holds, REITs work to have buyers who are in need of regular income, even though they provide an opportunity to possess adore, too.

This tactic is named list financing spending

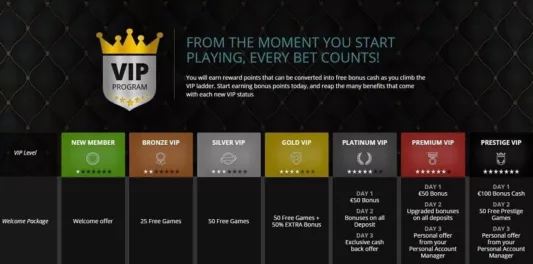

But the individuals enhancements would probably occurs if the device is actually unoccupied, and therefore there’s no book arriving when you’re money is are spent. Another significant benefit to merchandising investors ‘s the analytical and you can look https://happy-gambler.com/club-world-casino/ suggestions provided with the new money. Including information about gotten assets and you can administration’s direction to the viability and performance away from particular a property assets so when a valuable asset class. For those who invest in local rental features, you then become a landlord—which means you need to believe in the event the you will be comfy in this part.

An agent’s annual shell out greatly utilizes the conversion they make within the a given 12 months, if they concentrate on attempting to sell industrial otherwise attributes. Industrial agents, an average of, is secure a notably big wage as his or her profits are generally large, as the part of commercial a property provides a reduced product sales return. The actual estate industry is a critical element of the us savings, contributing somewhat to various sectors for example construction, financing, and you may do-it-yourself. This includes various things, of to find, selling, and you can renting features to assets government, rental, and you can relevant features. The brand new average price of property sold in Their state reached $730,2 hundred, reflecting the brand new continued request and you can enjoy regarding the housing market.

Because the an investor eyeing abode in the usa, you’ll need to ensure that your particular investment results in the fresh development or maintenance of at least ten permanent complete-time work for qualified U.S. specialists. For those who set enough currency on the a You company, this program can also be allow you to and your family real time indeed there forever. An enthusiastic EB-5 charge are another kind of charge to have overseas investors who wish to inhabit the us. They’re able to money renovations and you may updates, and make a house in a position on the market. Investing in a house is frequently promoted as a way to secure extra income which help generate wealth over time. The good news is that you do not should be a good mogul to get going.

Beyond home-strengthening feel, it’s best if you take care of loads of money but if you run into cost overruns or perhaps the property doesn’t offer immediately. The newest incorporated provider offers a full list of percentage choices you to bridge the brand new pit ranging from paper and you may electronic costs while keeping a higher bank-stages top within the a safe online ecosystem. Property executives get profile to the the commission accumulated, no matter what systems and you will banks, to your a central dash. Making use of a single post office box, Lockbox aggregates checks out of numerous financial institutions, features and bookkeeping apps.

Is it Stupid to Chase Couch potato Money since the a citizen?

A property opportunities usually have a decreased relationship that have brings and you may securities, meaning they can work well even when almost every other places try struggling. Naturally, there are some downsides to consider just before spending in the home-based REITs. The first is your dividends gained as a result of a residential REIT are taxed because the ordinary money. Based on their taxation group and how most of a return their REIT assets provide, it has the possibility to increase your tax weight from the 12 months. However, all the investment often affect your own nonexempt earnings eventually.

Centered inside the 1993, The new Motley Deceive try an economic functions team intent on making the country smarter, happier, and you may wealthier. One another could possibly offer a diverse collection out of home assets—at a high price, and could end up being the right fit for you if you are merely starting using. Traders is always to select the right option for the particular spending requires, if or not an enthusiastic ETF, shared money, otherwise a variety of both. Arielle O’Shea leads the newest investing and you can fees group from the NerdWallet.